4. Bond

文章目录

- 1. Corporate Bonds

- 1.1 Introduction of Bonds

- 1.1.1 Definition

- 1.1.2 Basic Features

- 1.1.3 Cash flow structure of a plain vanilla bond

- 1.1.4 Bond Price

- 1.2 Bond Markets

- 1.2.1 Bond Issuance

- 1.2.2 Bond Trading

- 1.2.3 Classification of Bonds

- 1.3 Bond Indenture

- 3.1 Bond Indentures

- 3.2 Corporate Trustee

- 3.3 Debt Retirement

- 3.4 Covenant

- 1.4 Bond Risks

- 1.4.1 Credit Risks

- 1.4.2 Credit Rating and High-yield Bonds

- 1.4.3 Event Risk

1. Corporate Bonds

1.1 Introduction of Bonds

1.1.1 Definition

A bond is a debt instrument sold by the bond issuer(the borrower) to bondholders(the lenders). The bond issuer agrees to make payments of interest and principal to bondholders. The principal of a bond (also called its face value or par value) is the amount the issuer has promised to repay at maturity.

1.1.2 Basic Features

Issuer/Borrower

- Supranational Organizations, such as World Bank and IMF.

- Sovereign (national) governments, such as China and Japan.

- Non-sovereign (local) governments, such as city of Edmonton,

- Quasi-government entities, such as agencies that are owned by government.

- Companies, such as corporate issuers.

Par Value/Face Value/Maturity Value: The amount that the issuer agrees to repay the bondholders on the maturity date.

Maturity date; tender(time to maturity)

- Money market securities: one year or less

- Capital market securities: more than one year.

- Perpetual bond: no stated maturity date.

Coupon

Coupon Rate/Nominal Rate: The interest rate that the issuer agrees to pay each year until the maturity date.

Coupon = coupon rate ×\times× par value

Coupon Frequency: Coupon payments may be made annually, semi-annually, quarterly, or monthly, etc. Generally semi-annually paid in commonwealth countries, e.g. U.S, U.K.

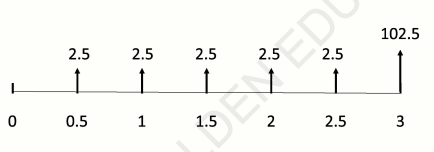

1.1.3 Cash flow structure of a plain vanilla bond

Example: A three-year bond has par value of $ 100100100 and coupon rate 5%5\%5%. Coupon payments are made semi-annually.

1.1.4 Bond Price

Discounted Cash Flow Approach: The bond will pay promised payment of coupon and principal. Use the appropriate discount rate to discount the primised cash flows.

P=∑t=1nCt(1+r)t+FV(1+r)nP=\sum^n_{t=1}\frac{C_t}{(1+r)^t}+\frac{FV}{(1+r)^n}P=t=1∑n(1+r)tCt+(1+r)nFV

Example: A two-year bond has par value of $100100100 and coupon rate 5%5\%5%. Coupon payment are made semi-annually. The market discount rate is 6%, the price of the bond should be:

P=2.5(1+6%2)+2.5(1+6%2)2+2.5(1+6%2)3+1022.5(1+6%2)4=98.14P=\frac{2.5}{(1+\frac{6\%}{2})}+\frac{2.5}{(1+\frac{6\%}{2})^2}+\frac{2.5}{(1+\frac{6\%}{2})^3}+\frac{1022.5}{(1+\frac{6\%}{2})^4}=98.14P=(1+26%)2.5+(1+26%)22.5+(1+26%)32.5+(1+26%)41022.5=98.14

N=4N=4N=4; PMT=2.5PMT=2.5PMT=2.5; FV=100FV=100FV=100; 1/Y=31/Y=31/Y=3 →PV=−98.14\to PV=-98.14→PV=−98.14

1.2 Bond Markets

1.2.1 Bond Issuance

Corporate bond issuances are typically arrangement by investment banks.

Private placement: bonds are placed with a small number of large institution.

- Fewer registration requirement

- Rating agencies are not involved

- The issuance cost is lower

- The issuance can be completed quickly

- The issuance can be relatively small

Public issue: the investment bank buys the bonds from the corporation and the tries to sell them to investors.

- The investment bank acts as the underwriter.

- The investment bank’s profit is earned from the price different, but face risks.

- The bonds are given rating by rating agencies.

Interest rates for private placement bonds are generally higher than those for equivalent publicly issued bonds.

1.2.2 Bond Trading

Bonds issued via private placements are often not traded. Instead, they are held by the original purchases until maturity.

Bonds issued in a public offering are typically traded in the over-the-counter(OTC) market.

Bond dealers buy and sell bonds, and they aim to make a profit from the price difference.(bid-ask spreads)

Liquidity is an important issue in bond trading. It is the ability to turn an asset into cash within a reasonable time period at reasonable price.

Markets where the trading volume is high tend to be highly liquid and have low bid-ask spreads(and vice versa).

Part of the yield on a bond is compensation for its liquidity risk.

1.2.3 Classification of Bonds

Classification by type of issuer

Government and government-related sector

Corporate sector(Utilities / Transportation companies / Industrials Financial institutions/ Internationals)

Classification by original maturity

Corporate bonds have an original maturity of at least one year.

- Short-term notes: up tp 5 years

- Medium-term bonds: between 5 and 12 years

- Long-term bonds: greater than 12 years

Instruments with an original maturity of less than one year are referred to as commercial paper.

Classification by interest rate

Fixed-rate bonds: pay the same rate of interest throughout their life.

Zero-coupon bonds: pay no coupons to the holder(sell at a discount to the principal amount).

Floating-rate bonds(floating-rate notes(FRNs) or variable rate bonds): coupon rate is linked to an external reference rate, such as LIBOR.

- Coupon rate = reference rate + spread

- Reference rate reset periodically, spread is usually constant.

- Coupon payments are in arrears: based on previous period’s reference rate.

- Basis point: equal to 0.01%0.01\%0.01%

Example: A company has issued a floating-rate note with a coupon rate equal to the three-month Libor+65\text{Libor} + 65Libor+65 basis points. Interest payments are made quarterly on 31 March, 30 June, 30 September, and 31 December. On 31 March and 30 June, the three-month Libor is 1.55%1.55\%1.55% and 1.35%1.35\%1.35%, respectively. The coupon rate for the interest payment made on 30 June is:

The coupon rate that applies to the interest payment due on 30 June is based on the three-month Libor rate prevailing on 31 March. Thus, the coupon rate is 1.55%+0.65%=2.20%1.55\%+0.65\%=2.20\%1.55%+0.65%=2.20%

Classification by collateral

Collateral is a way to reduce/alleviate credit risk. A default leads to either a reorganization or an asset liquidation.A bondholder with collateral should fare better than one without collateral.

-

Mortgage bonds: private specific assets(e.g., homes and commercial property) as collateral.

-

Collateral trust bonds: bonds where shares, bonds, or other securities issued by another company are pledged as collateral. Usually, the other company is a subsidiary of the issue.

-

Equipment trust certificates(ETC): debt instruments used to finance the purchase of an asset. The title to the property vests with the trustee, who then leases it to the borrower for an amount sufficient to provide the leader with the return they have been promised. When the debt is full repaid, the borrower obtains the title to the asset.

-

Debenture bonds: are unsecured bonds(no collateral). The rank below mortgage bonds and collateral trust bonds, and are likely to pay a higher interest rate. A subordinated debenture ranks below other debentures, and required a higher rate of interest than unsubordinated debentures.

-

Guaranteed bonds: bonds are issued by one company are guaranteed by another company. The correlation between the financial performance of the issuer and the guarantor increases, guarantee is less valuable.

1.3 Bond Indenture

3.1 Bond Indentures

Bond Indentures: are legal contracts between a bond issuer and the bondholders defining the important features of a bond issue.

- Covenant

- Debt early retirement (if any)

3.2 Corporate Trustee

Corporate trustee: a financial institution that look after the interests of the bondholders and ensures that the issuer complies with the bond indentures.

- Act on behalf of bondholders

- Reports periodically to the bondholders

- Its specific duties are itemized in the bond indentures and

the trustee is under no obligation to exceed those duties.

3.3 Debt Retirement

Call Provisions (Callable bond): bond indenture can sometimes allow the issuer to call the bond at a certain price at a certain time.

- Can protect issuers against decline in interest rate,

- Call price: the price to redeem the bond.

- Call provisions are beneficial to the issuer.

- Investors face more reinvestment risk, and will ask higher yield, and pay lower price.

- A make-whole call provision

- Call price: equals to the present value of the remaining cash flows owed to the bondholder.

Put Provisions (Putable bond): Gives the bondholders the right to sell the bond back to the issuer at a pre-determined price on specified dates.

- Can protect investor against increase in interest rate.

- Put price: the price to sell back the bond.

- Put provisions are beneficial to the investors.

- Investors will ask lower yield, and pay higher price.

Convertible bond: gives bondholder the right to exchange the bond for a specified number of common shares in issuing company.

- Hybrid security with both debt and equity features.

- Conversion price: the share price at which convertible bond can be converted into shares.

- Conversion provisions are beneficial to bondholder.

- Investors will ask lower yield, and pay higher price.

A sinking fund is an arrangement where it is agreed that bonds will be retired periodically before maturity

- The issuer may provide funds to the bond trustee so that the trustee can retire the bonds,

- Advantage:

- Decrease debt burden of issuer, which would decrease the default rate of issuer.

- The amount borrowed declines in lockstep with the

declining value of the collateral

Maintenance and replacement funds require the issuer to maintain the value of the collateral with property additions. If property additions are not made, cash can be sued to retire debt.

Selling property: The bond indenture will normally allow a company to sell assets that have been pledged as collateral, as long as the proceeds from the sale are used to retire the bonds,

- A tender offer is simply an offer to purchase the bonds The offer can be at a fixed price or it can be calculated as the present value of future cashflow.

3.4 Covenant

Covenant: legally enforceable rules that borrowers and lenders agree on at the time of a new bond issue.

- Negative covenants (restrictive covenants)

- Positive covenants

- Financial covenants

Bonds issued by highly creditworthy firms generally contain few covenants.

1.4 Bond Risks

Risk Faced by Bondholders: market risk(interest rate), liquidity risk, credit risk, event risk.

1.4.1 Credit Risks

Credit ratings measure default risk.

Default: occurs when a bond issuer fails to make the agreed upon payments to the bondholders.

- The issuing company may then reorganize itself or sell its assets to meet creditor claims.

- Ranking of claimants: bondholders always rank above equity holders.

Credit spread risk: another risk faced by bondholders arises from changes in how the market prices credit risk(i.e., the credit spread)

Rbond=RBenchmark+CreditspreadR_{bond}=R_{Benchmark}+Credit\;spreadRbond=RBenchmark+Creditspread

Credit migration risk/downgrade risk: bond issuer’s creditworthiness deteriorates, or migrates lower, causing the yield spreads wider and the price lower.

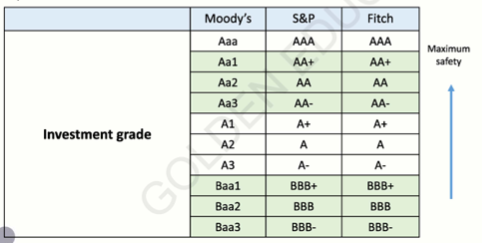

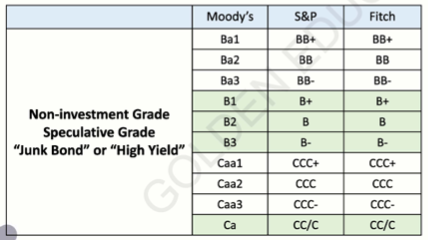

1.4.2 Credit Rating and High-yield Bonds

Ratings agencies, such as Moody’s, S&P, and Fitch provide opinions on the credit worthiness of bond issuers.

High-yield bonds (a.k.a, junk bonds) are those bonds rated below investment grade by ratings agencies.

Circumstances that give rise to high-yield bonds

- Sold by young and growing companies

- Fallen angels: the financial situation of the firm that issued investment-grade bonds deteriorate

- A company with stable cashflows increases its debt burden to benefit shareholders

High-yield bonds sometimes have unusual features:

- A deferred-coupon bond is a bond that pays no interest for a specified time period, after which time a specified coupon is paid in the usual manner.

- A step-up bond is a bond where the coupon increases with time.

- A payment-in-kind bond is a bond where the issuer has the option of providing the holder with additional bonds in lieu of interest.

- An extendable reset bond is a bond where the coupon is reset annually (or more frequently) to maintain the price of the bond at some level.

- The issuer may have rights to call the bond from the proceeds of an equity issue,

1.4.3 Event Risk

There are many events (e.g., natural disasters or the death of a CEO) that could adversely affect bonds. An important type of event risk is that of a large increase in leverage (e.g., leveraged buyouts, share buyback, etc).